Finns oppose new gambling system amid concerns over marketing and harm

GamblingVirve Marionneau and Paula Jääskeläinen, CEACG Published 28 Jan 2026

Finland will partially dismantle its gambling monopoly system in 2027, allowing private operators to offer and market sports betting and online casino products. A recent representative population study of 2,219 participants, conducted by the University of Helsinki's Centre for Research on Addiction Control and Governance (CEACG), examined citizens’ views on the forthcoming licensing system. The findings indicate widespread skepticism: many Finns expect the reform to increase both exposure to gambling marketing and gambling-related harm.

The survey found that 64 per cent of respondents had gambled during the past 12 months. Among them, 13 per cent reported gambling with operators outside the monopoly system, with online slot machines being the most popular offshore product. Overall, gambling-related harms were reported by 6.3 per cent of respondents during the past year, most commonly financial hardship and mental health issues.

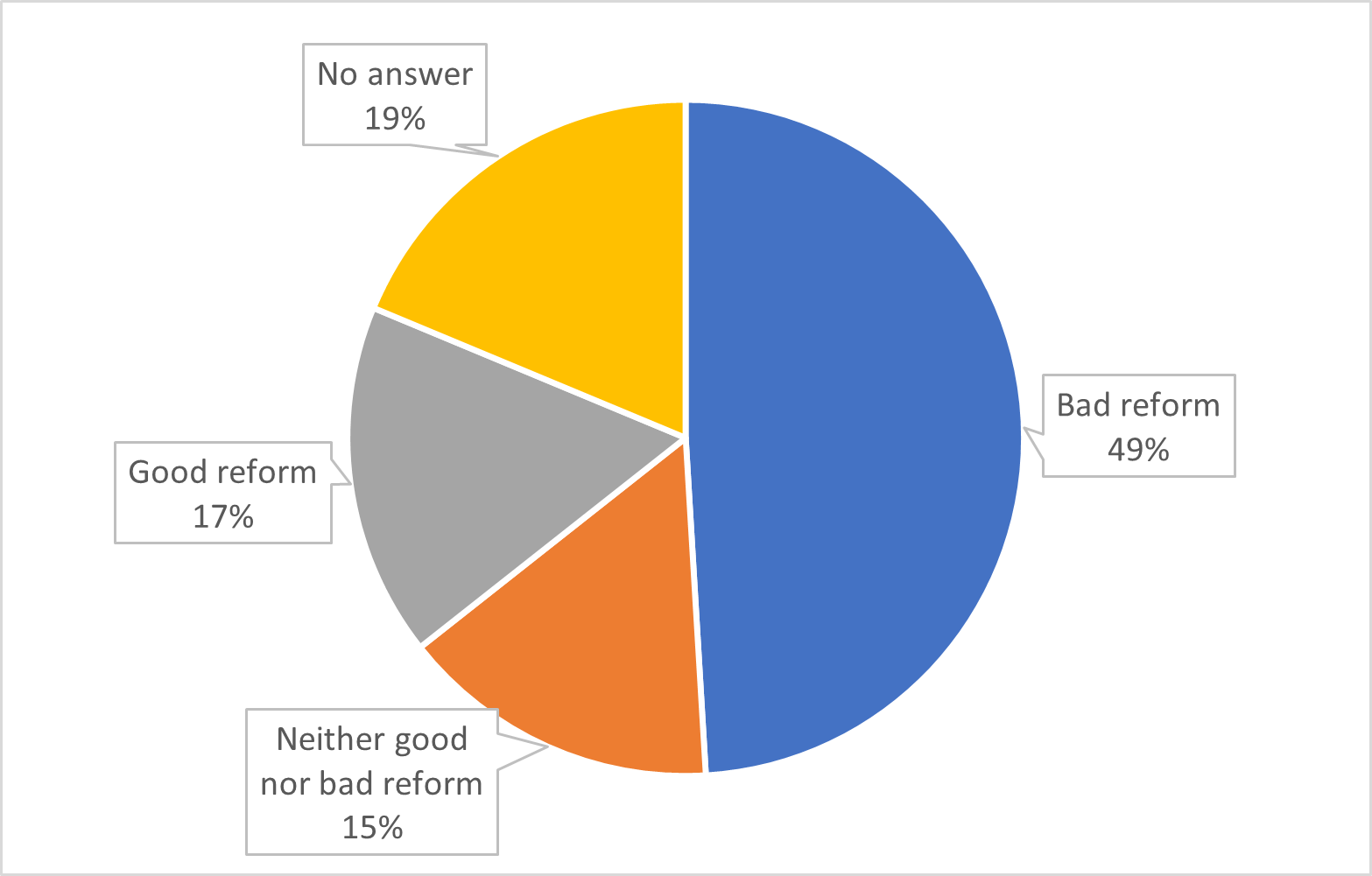

Participants were also asked to evaluate the new gambling system. Nearly half of the respondents (49 per cent) opposed the policy change, while only 17 per cent viewed it positively. Figure 1 presents these attitudes toward the Finnish gambling system reform.

Figure 1. Citizen opinions regarding the Finnish gambling system change (% of respondents N=2,219)

Gambling harms will increase, state revenues will decrease

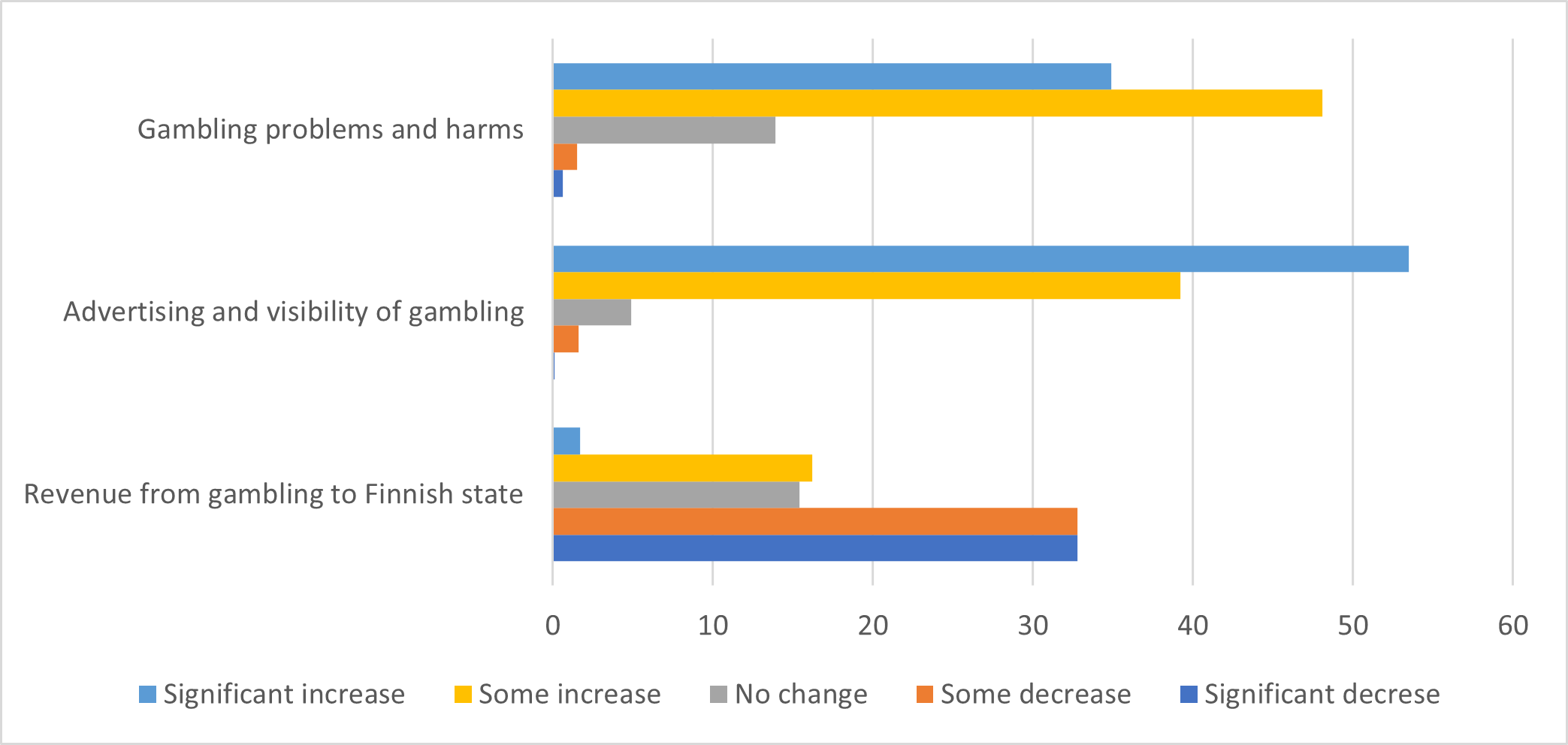

Respondents were also asked about their perceptions of how the new gambling system would affect gambling-related harms, advertising, and state revenue. The majority believed that harms and marketing would increase, while state revenue would decrease. These expectations are illustrated in Figure 2.

The survey results align with international research evidence from countries that have introduced competitive gambling markets. Experiences from Sweden, the Netherlands, Germany and Canada (Ontario) show that licensing systems have led to increased advertising and harms. The new Finnish system will also feature a comparatively low tax rate for licensees (22 per cent, below the European average), which is likely to influence state revenue negatively. Currently, Veikkaus transfers all profits directly to the state.

Finns want to be protected from gambling marketing

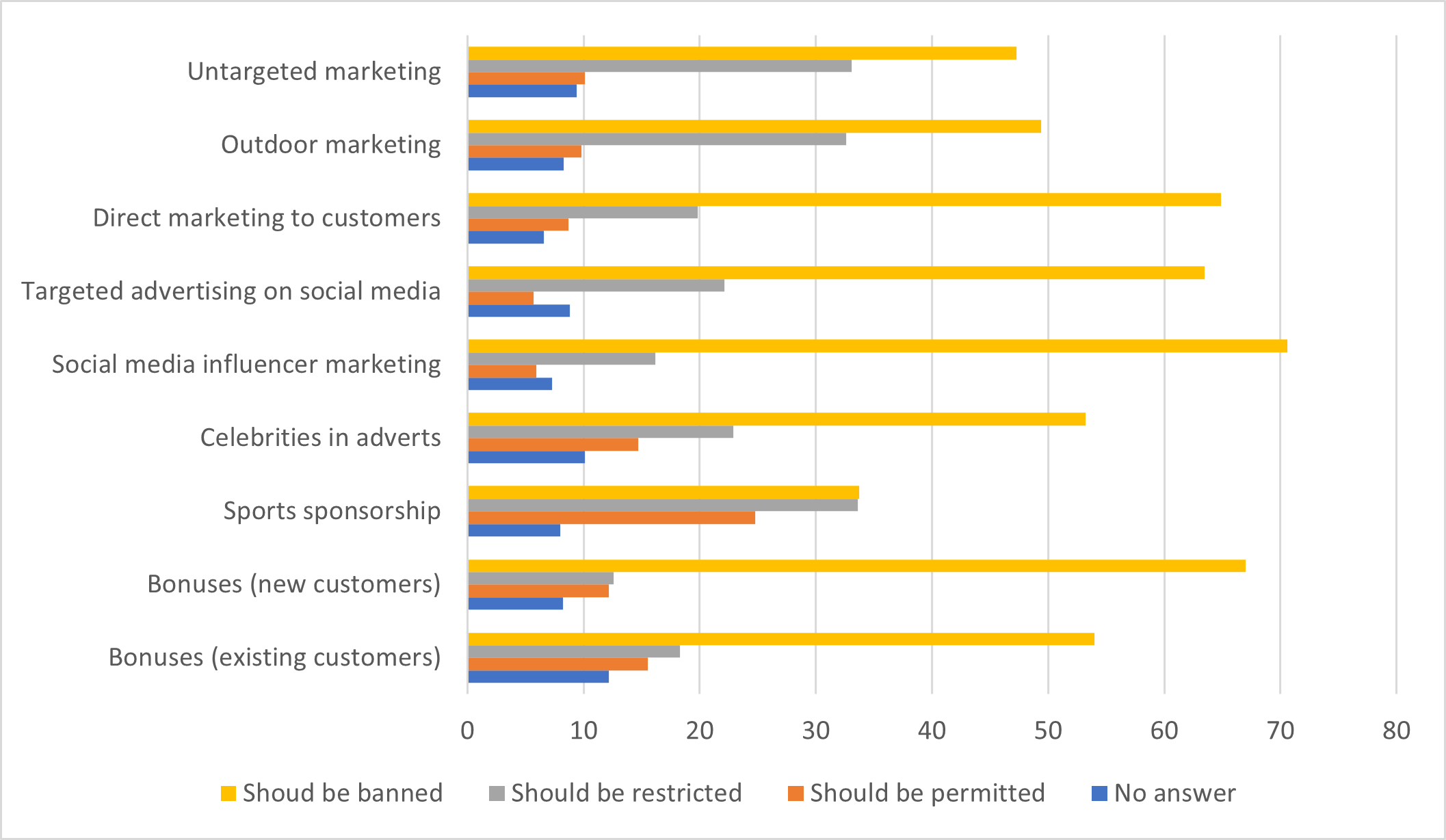

According to the survey, most Finns support significant restrictions, or even bans, on various forms of gambling marketing (Figure 3). Participants were particularly critical of online marketing: over half favoured banning direct marketing, targeted social media marketing, and social media influencer marketing. Respondents were also highly critical of bonuses, particularly to new customers (so-called welcome bonuses).

These citizen opinions are also supported by research showing that marketing increases gambling consumption and intentions to gamble. Compared with many European countries, the new Finnish gambling system allows relatively permissive marketing and sponsorship, enabling license holders to advertise their products broadly across media, outdoor spaces, and online platforms. This approach appears misaligned with citizens’ strong preference for protection from gambling marketing.

The article is written by

Virve Marionneau and Paula Jääskeläinen, CEACG

on the request of PopNAD