Regulations across the Nordic and Baltic countries

Image: iStock

Regulations across the Nordic and Baltic countries

Common regulations

The European Union Tobacco Products Directive (2014/40/EU) (TPD) was adopted in May 2014 and entered into force in May 2016 (Directive 2014/40), applying to all member states of the EU. Among the Nordic and Baltic countries, it included Denmark, Estonia, Finland, Latvia, Lithuania, and Sweden. This directive takes into account the WHO Framework Convention on Tobacco Control FCTC (described below) and adds several rules on the sale of tobacco products and electronic cigarettes to the previous directive, adopted in 2001. Among the regulations are: 1) prohibition of cigarettes, roll-your-own, and heated tobacco products with characterising flavourings, 2) mandatory health warnings on tobacco products, 3) prohibition of tobacco for oral use (does not apply to Sweden), 4) nicotine-containing liquid used to refill containers or disposable electronic cigarettes must not exceed a nicotine concentration of 20 mg/ml, 5) tanks for electronic cigarettes and disposables must not exceed 2ml e-liquid. Refill bottles may not exceed 10 ml e-liquid, 6) electronic cigarettes must be child- and tamper-proof. As Norway and Iceland are not members of the EU, but belong to the European Economic Area (EEA), there is a separate process for implementing this directive. As a result, the TPD is expected to enter into force in Norway in 2025. However, both countries have already implemented some TPD measures into national laws. Furthermore, Norway (alongside Sweden) is exempt from the TPD ban on oral tobacco products also called ‘snus’ (Helsedirektoratet, 2023).

Besides the TPD, the global Framework Convention on Tobacco Control (FCTC) developed by the World Health Organization has been in force since February 2005. Some of the obligations laid out in the FCTC are: 1) implementation of tax and price measures to reduce the demand for tobacco products, 2) provide protection from tobacco smoke exposure in several public places, 3) ensure that product packaging and labelling must not be misleading and must carry health warnings, 4) undertake ban on tobacco advertising, promotion, and sponsorship, 5) prohibit tobacco sales to minors, etc. Further, all parties of the FCTC are obligated to prevent and reduce nicotine addiction (World Health Organization, 2003). All of the included Nordic and Baltic countries have joined the FCTC (United Nations, 2024).

The current TPD and FCTC do not include tobacco-free nicotine products, except for electronic cigarettes. For example, nicotine pouches are not consistently regulated in the EU or globally. However, all parties of the FCTC are obligated to develop appropriate policies for preventing and reducing nicotine addiction in general.

Summary of national regulations

Table 2. Summary of national regulations in the Nordic and Baltic countries

Sales ban | Plain packaging | Health warnings | Flavour ban | Point of sale ban | Advertising ban | Smoke-/nicotine-free places | Age limit | Taxes* € | |

Cigarettes | |||||||||

Denmark | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 18 y | min. 0.26 |

Finland | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 18 y | 0.37 |

Iceland | - | - | ✓ | - | ✓ | ✓ | ✓ | 18 y | 0.261 |

Norway | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | 18 y | 0.27 |

Sweden | - | - | ✓ | ✓ | (✓) | ✓ | ✓ | 18 y | min. 0.17 |

Estonia | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | 18 y | 0.17 |

Latvia | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | 20 y1 | min. 0.16 |

Lithuania | - | - | ✓ | ✓ | - | ✓ | ✓ | 18 y | min 0.151 |

E-cigarettes | |||||||||

Denmark | - | ✓ | ✓ | (✓) | ✓ | ✓ | ✓ | 18 y | 0.20–0.34 |

Finland | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 18 y | 0.3 |

Iceland | - | - | ✓ | - | ✓ | ✓ | ✓ | 18 y | 0.28–0.411 |

Norway | - | - | - | ✓ | ✓ | ✓ | ✓ | 18 y | 0.44 |

Sweden | - | - | ✓ | - | (✓) | (✓) | ✓ | 18 y | 0.36 |

Estonia | - | - | ✓ | (✓) | ✓ | ✓ | ✓ | 18 y | 0.221 |

Latvia | - | - | ✓ | ✓1 | ✓ | ✓ | ✓ | 20 y1 | 0.24 |

Lithuania | - | - | ✓ | ✓ | ✓1 | ✓ | ✓ | 18 y | 0.631 |

Nicotine pouches | |||||||||

Denmark | - | - | ✓ | - | ✓ | ✓ | ✓ | 18 y | 0.013 |

Finland | - | - | (✓) | - | ✓ | ✓ | - | 18 y | min 0.14 |

Iceland | - | - | ✓ | - | ✓ | ✓ | ✓ | 18 y | 0.05–0.141 |

Norway | ✓ | ||||||||

Sweden | - | - | ✓ | - | (✓) | (✓) | - | 18 y | 0.02 |

Estonia | - | - | ✓ | - | ✓ | ✓ | ✓ | 18 y | 0.221 |

Latvia | - | - | ✓ | ✓1 | ✓ | ✓ | ✓ | 20 y1 | 0.14 |

Lithuania | ✓ | ||||||||

Snus | |||||||||

Denmark | ✓ | ||||||||

Finland | ✓ | ||||||||

Iceland | ✓ | ||||||||

Norway | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | 18 y | 0.11 |

Sweden | - | - | ✓ | - | (✓) | ✓ | - | 18 y | 0.04 |

Estonia | ✓ | ||||||||

Latvia | ✓ | ||||||||

Lithuania | ✓ | ||||||||

*Taxes per cigarette, per ml of e-liquid, and per gram of nicotine pouches and snus. In Denmark, the tax for nicotine pouches is per mg of nicotine. In Norway the tax on snus is per gram of the packaging.

1 Entering into force 1 January 2025.

Overall guide to understanding figures on regulations

In the following sections, national regulations in the Nordic and Baltic countries are presented alongside with the development in the use of tobacco and nicotine products among the youth, for each country separately.

First, the current status of regulations on cigarettes, e-cigarettes, nicotine pouches, and snus is reported. Both nicotine pouches and snus regulations are covered, as the regulation of these products often differs within the same country. Regulations on packaging, health warnings, flavours, advertising, point of sale (POS) display, smoke-/nicotine-free places, age limits, and taxes are listed, if such regulations exist in the country. However, as cigarettes are primarily included for reference and most regulations for cigarettes are covered by the TPD, only regulations that go beyond the TPD requirements are highlighted, along with the current taxes on cigarettes. Hence, the regulations for cigarettes are not described in full detail. Overall, regulations that have entered into force or were adopted by mid-December 2024 are included. Regulative changes still under consideration at this time are not included here.

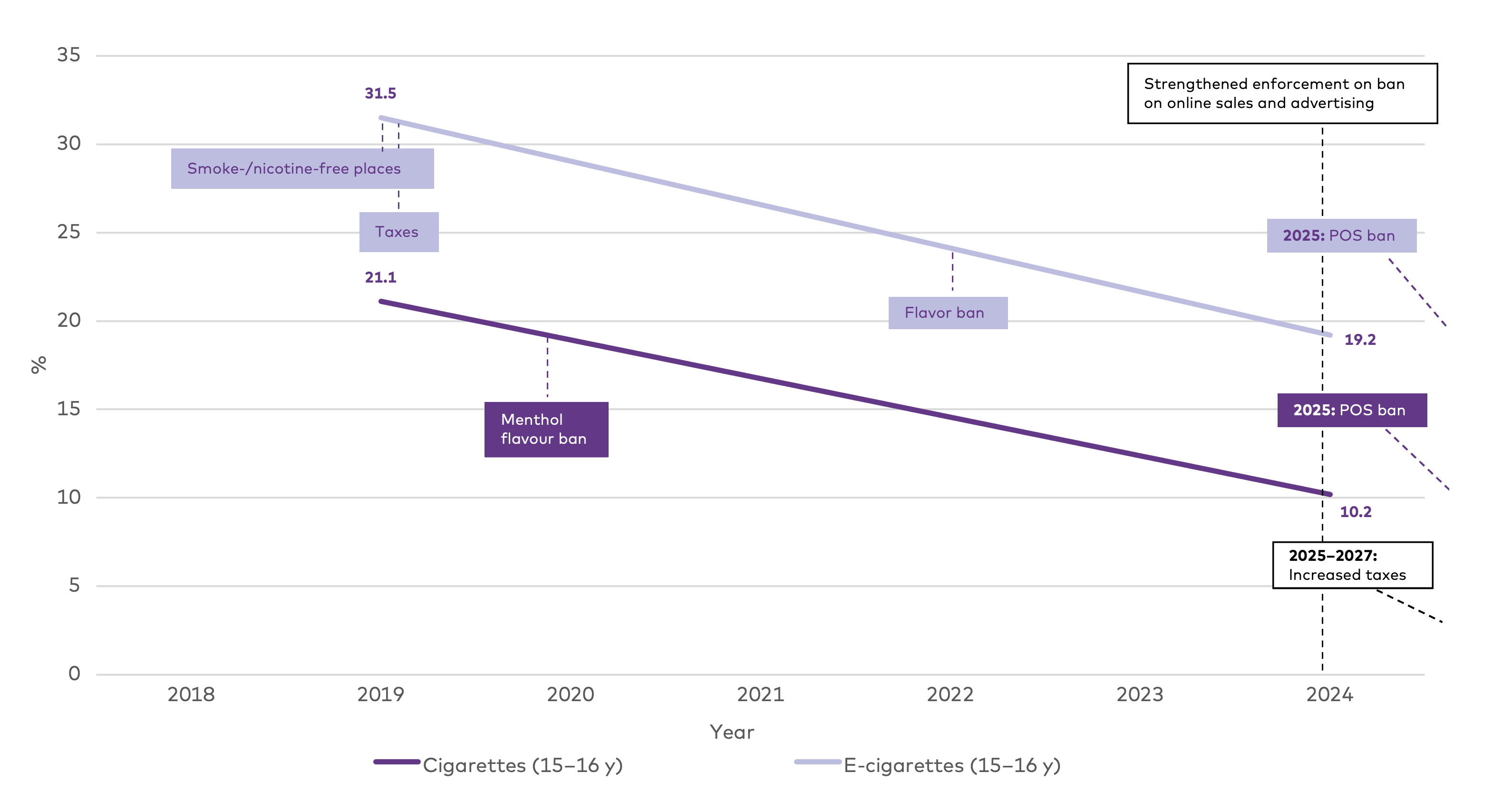

Second, a graph illustrates how the prevalence of cigarette, e-cigarette, and oral nicotine product use has evolved in the country. This graph also incorporates most of the above-mentioned regulations (and point of entry into force). It should be noted that some regulations on cigarettes that were not presented in the text may be presented here for explanatory reasons. Only the regulations located – either by search or by the representatives’ review – are included in these graphs. They may thus not present a complete picture of the country’s regulations.

Regulations are presented in colour-coded boxes attached to the development graph of the corresponding product. For example, in Sweden (Figure 4.5), regulations in dark green boxes are linked to the dark green curve, hence representing cigarette regulations. As oral nicotine products include both snus and nicotine pouches, light green boxes without visible outer lines indicate regulations specific to nicotine pouches, while light green boxes with darker dashed outer lines indicate regulations for snus.

White boxes with black outer lines indicate regulations that apply to all products in the graph, unless otherwise stated below the figure. Boxes on regulation are placed around the time of entry into force and may not precisely align with the timing of prevalence data collection in each country.

Nordic countries

Denmark

Regulation of tobacco and nicotine products in Denmark is covered by several laws, such as the Law on Tobacco Products (Indenrigs- og Sundhedsministeriet, 2024b), Electronic Cigarettes (Indenrigs- og Sundhedsministeriet, 2021a), and the Law prohibiting the sale of tobacco and alcohol to persons under the age of 18 (Indenrigs- og Sundhedsministeriet, 2024a). The regulatory landscape concerning tobacco and nicotine products has changed markedly over the past five years in Denmark. For example, a political agreement was reached in 2019 to strengthen tobacco controls regarding tobacco and nicotine products among youth (Sundheds- og indenrigsministeriet, 2019), followed by a prevention plan in 2023 aimed at youth (Sundheds- og indenrigsministeriet, 2023).

Cigarettes are regulated by the Law on Tobacco Products. Beyond the TPD 2014, Denmark has implemented plain packaging and point-of-sale (POS) display bans for cigarettes. Furthermore, the use of cigarettes is prohibited in school areas and during school hours. Cigarettes are subject to a tax of DKK 1.94 per cigarette + 1% of the retail price, which results in a minimum tax of €0.26 per cigarette, depending on the retail price (Skat, 2020).

Electronic cigarettes are regulated by the Law on Electronic Cigarettes, which covers both battery-driven and disposable e-cigarettes. E-cigarettes must come in plain packaging and carry a health warning. The content of characteristic flavours is restricted to menthol and tobacco. All sorts of advertising, sponsoring, and distribution of e-cigarettes are prohibited, and nicotine pouches may not be visible at POS. The use of e-cigarettes is prohibited in school areas and during school hours. Denmark has also prohibited the sale of e-cigarettes to people under 18 years. E-liquids containing 12 mg nicotine or less are subject to a tax of DKK 1.5 (€0.2) per ml e-liquid. E-liquids containing more than 12 mg nicotine are subject to a tax of DKK 2.5 (€0.34) per ml e-liquid (Folketinget, 2021).

Nicotine pouches are regulated as tobacco surrogates in the Law on Tobacco Products. Packaging for nicotine pouches must carry a health warning, but there are no requirements of plain packaging. The content of characteristic flavours is not regulated. All sorts of advertisement, sponsoring, and distribution of nicotine pouches are prohibited, and nicotine pouches may not be visible at POS. The use of nicotine pouches is prohibited in school areas and during school hours (Indenrigs- og Sundhedsministeriet, 2021b). It is illegal to sell nicotine pouches to people under 18 years in Denmark. Nicotine pouches are subject to a tax of DKK 0.1 (€0.013) per mg nicotine (Skatteministeriet, 2024).

Snus is prohibited in Denmark in accordance with the TPD 2014.

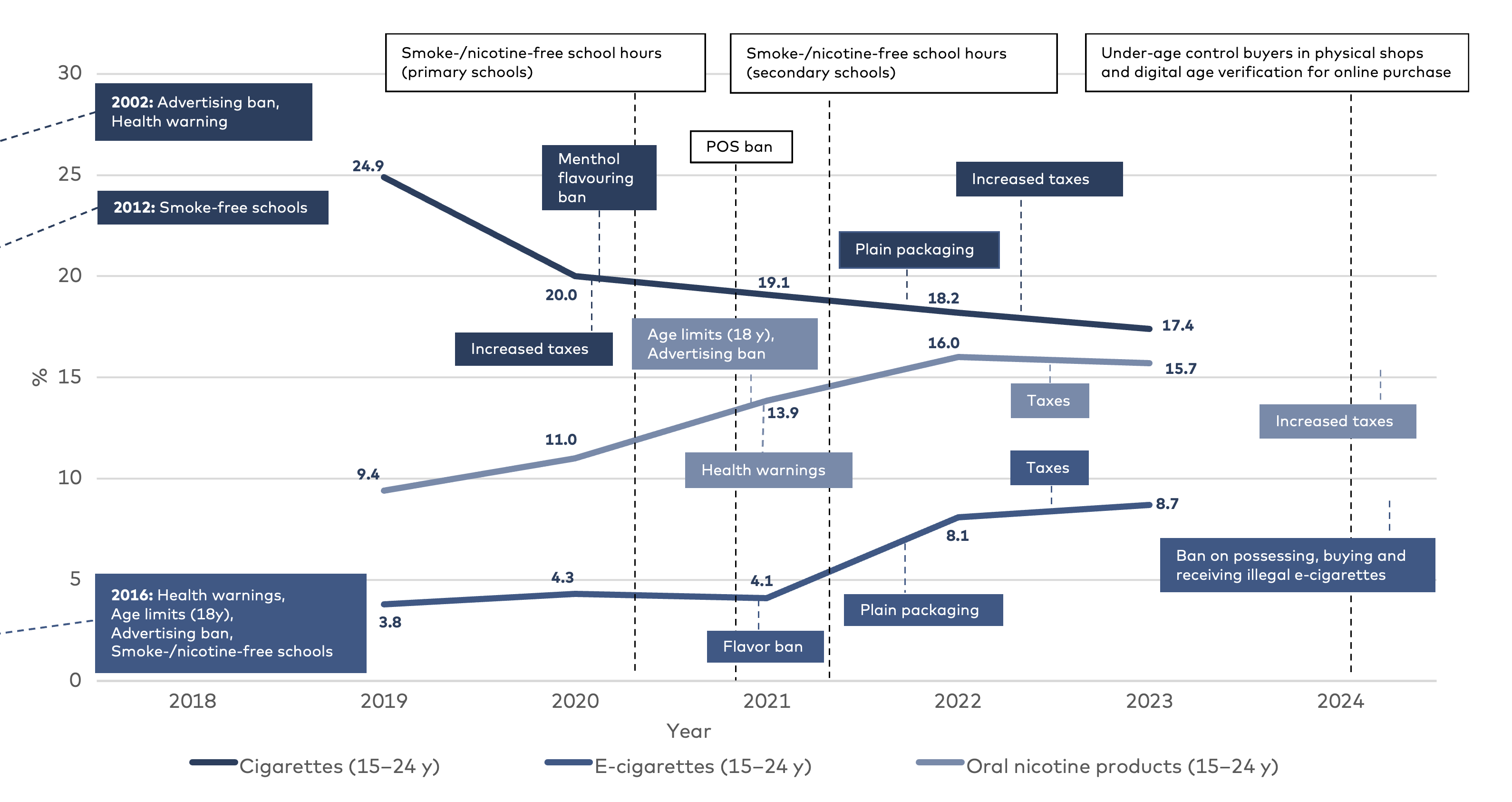

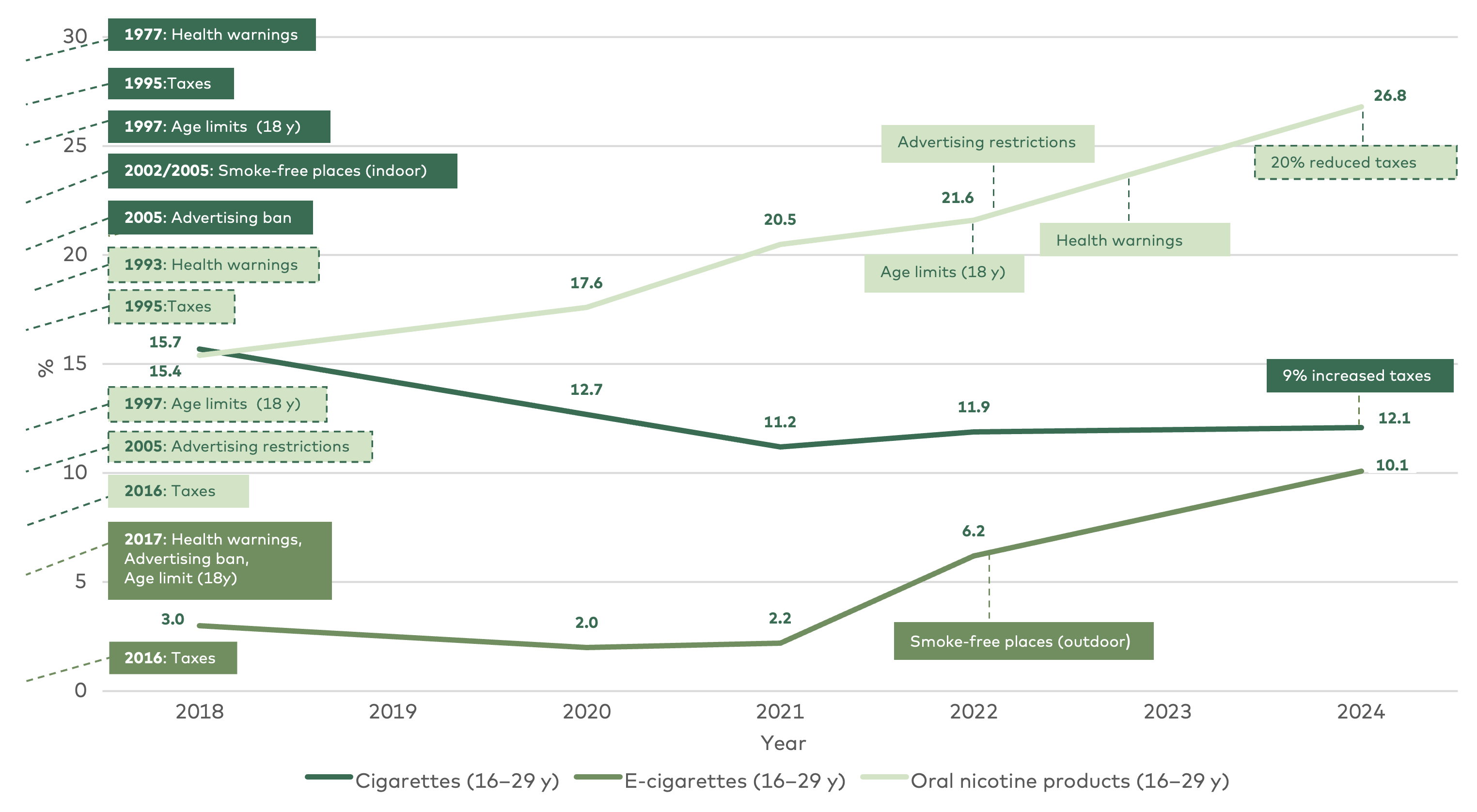

Figure 4.1. Use and regulations of cigarettes, e-cigarettes, and oral nicotine products in Denmark from 2018–2024

Prevalence data: Danish Smoking Habits 2019 + §SMOKE Study 2020–2023.

Finland

In Finland, nicotine products are regulated by the Tobacco Act (549/2016), which has been amended several times since 2016 (Sosiaali- ja terveysministeriö, 2016). In 2022, amendments to this law led to stricter regulations for packaging and smoke-free environments. Until April 2023, nicotine pouches were regulated under the Medicines Act, but have since been regulated by the Tobacco Act and the Chemicals Act (Sosiaali- ja terveysministeriö, 2013; Tukes, 2023; Valvira, 2023). Also, stricter regulation was introduced for HTPs in the Tobacco Act in 2023 (Sosiaali- ja terveysministeriö, 2016). Most recently, further amendments to the Tobacco Act are to be proposed, mainly regarding nicotine pouches. However, by mid-December 2024, none of these proposals had entered into force. It should be noted that Åland (an autonomous region of Finland) has a tobacco legislation of its own, therefore the following regulations may deviate from those in Åland.

Cigarettes are regulated by the Tobacco Act. Beyond the TPD 2014, Finland requires plain packaging and a POS display ban for cigarettes (except in stores only selling such products). Also, public beaches are smoke-free from May to September. Cigarettes are subject to a minimum tax of €0.37 per cigarette (Vero, 2024).

E-cigarettes are regulated by the Tobacco Act. E-cigarettes, e-liquids, and refill containers must be in plain packaging and display a health warning. The content of characteristic flavours is prohibited in both nicotine-containing and nicotine-free e-liquids. Advertising is prohibited, and e-cigarettes and related products may not be visible at POS (except in stores only selling such products). The use of e-cigarettes is prohibited in several public places, including daycare and educational institutions. Also, public beaches are smoke-free from May to September. The legal age for buying e-cigarettes and e-liquids in Finland is 18 years. E-liquids, both those that contain nicotine and those that do not, are subject to a tax of €0.3 per ml of liquid (Vero, 2024).

Nicotine pouches are defined as a tobacco substitute by the Tobacco Act and are subject to the Chemicals Act. Packaging for nicotine pouches must be labelled as harmful in accordance with the Chemicals Act, but there are no requirements of plain packaging. The content of characteristic flavours is not regulated. Advertising is prohibited and nicotine pouches are subject to a POS display ban. The legal age for buying nicotine pouches in Finland is 18 years. Nicotine pouches are subject to a relative tax of 10% of the product price and a tax of €0.1 per gram of product. However, the minimum tax is €0.14 per gram of product (Vero, 2024).

Snus is prohibited in Finland in accordance with the TPD 2014.

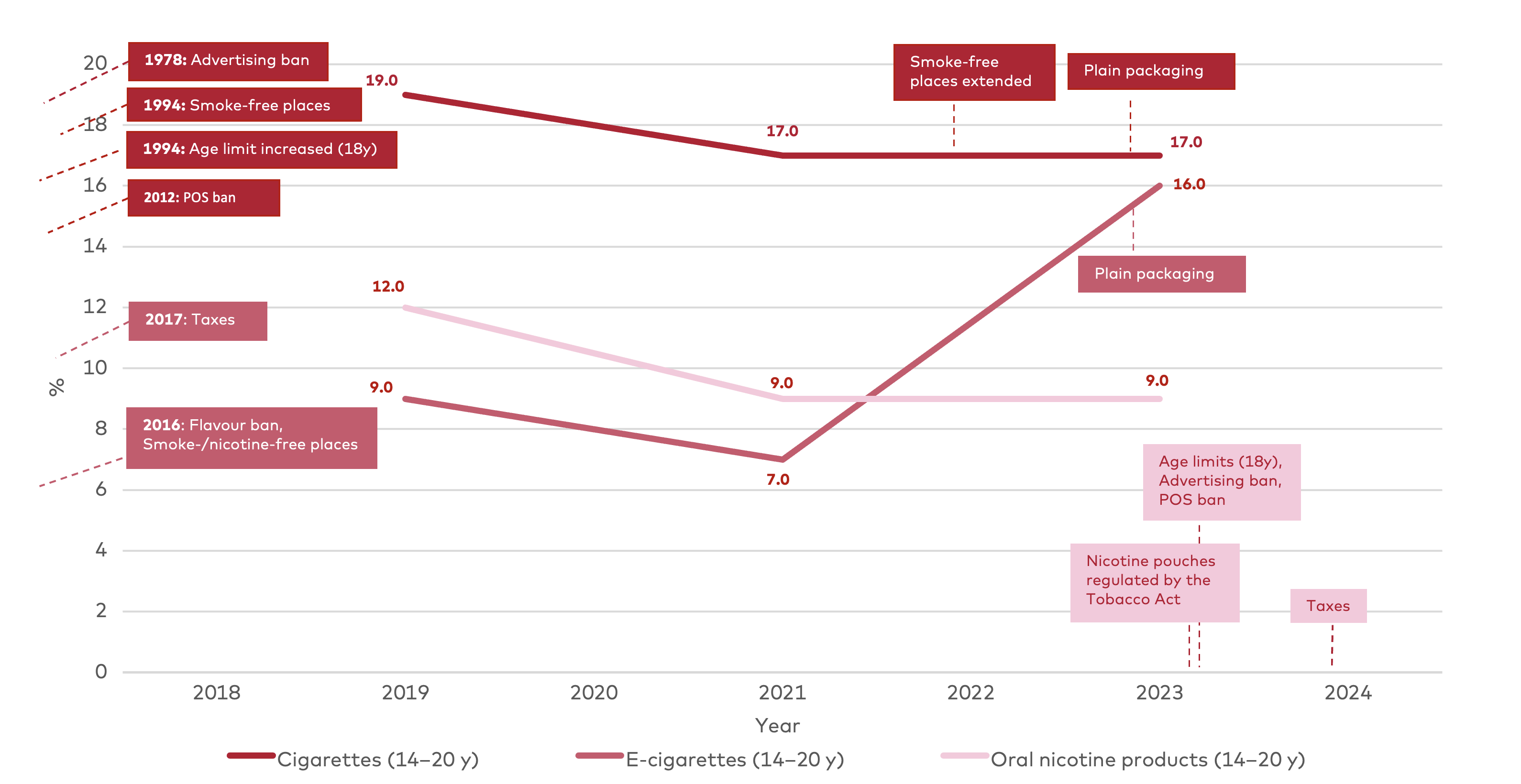

Figure 4.2. Use and regulations of cigarettes, e-cigarettes, and oral nicotine products in Finland from 2018–2024

Prevalence data: Tobacco Statistics 2019–2023.

Note: Oral nicotine products only include snus. The prevalence of nicotine pouches is therefore not included in this graph.

Note: Oral nicotine products only include snus. The prevalence of nicotine pouches is therefore not included in this graph.

Iceland

In Iceland, nicotine products are regulated by the Act on nicotine products, e-cigarettes, and refills for e-cigarettes (Heilbrigðisráðuneyti, 2022). In 2022, nicotine pouches were covered by the law as a result of a concern about the prevalent use among youth (Ministry of Health, 2021). Further, in 2022, a focus on education of the effects of nicotine products and e-cigarettes among youth was adopted by the law. Although Iceland is not a member of the EU, it is part of the EEA and has therefore incorporated certain measures from the TPD into national legislation.

Cigarettes are regulated by the Tobacco Control Act. Iceland requires a POS display ban for cigarettes, and from 1 January 2025, cigarettes will be subject to a tax of ISK 758.95 (€5.23) per pack of cigarettes (20 cigarettes) (Alþingi, 2024).

E-cigarettes are regulated by the Act on nicotine products, e-cigarettes, and refills for e-cigarettes. Packaging for e-cigarettes must display a health warning, but plain packaging is not required. However, packaging may not appeal to minors. The content of characteristic flavours is not regulated. Advertising in every form is prohibited and e-cigarettes must not be visible at POS (except in stores only selling such products). The use of e-cigarettes is not allowed at places where activities for children and young people take place, e.g. educational institutions. The legal age for buying e-cigarettes in Iceland is 18 years. As of 1 January 2025, e-liquids containing 12 mg nicotine or less are subject to a tax of ISK 40 (€0.28) per ml e-liquid. If the e-liquid contains more than 12 mg nicotine, a tax of ISK 60 (€0.41) per ml e-liquid is applied.

Nicotine pouches are regulated as a nicotine product by the Act on nicotine products, e-cigarettes, and refills for e-cigarettes. Packaging for nicotine pouches must provide a health warning, plain packaging is not required, but packaging may not appeal to minors. The content of characteristic flavours is not regulated. Advertising in every form is prohibited, and nicotine pouches must not be visible at POS (except in stores only selling such products). The use of nicotine pouches is not allowed in places where activities for children and young people take place. The legal age for buying nicotine pouches in Iceland is 18 years. As of 1 January 2025, nicotine pouches are subject to differing levels of taxation depending on nicotine content: ISK 8 (€0.05) per gram of product if 1–8 mg nicotine per gram, ISK 12 (€0.08) per gram of product if 8.1–12 mg nicotine per gram, ISK 15 (€0.10) per gram of product if 12.1–16 mg nicotine per gram, and ISK 20 (€0.14) per gram of product if 16.1–20 mg nicotine per gram.

Snus is prohibited in Iceland in accordance with the Tobacco Control Act and the EU directive on tobacco products (2024).

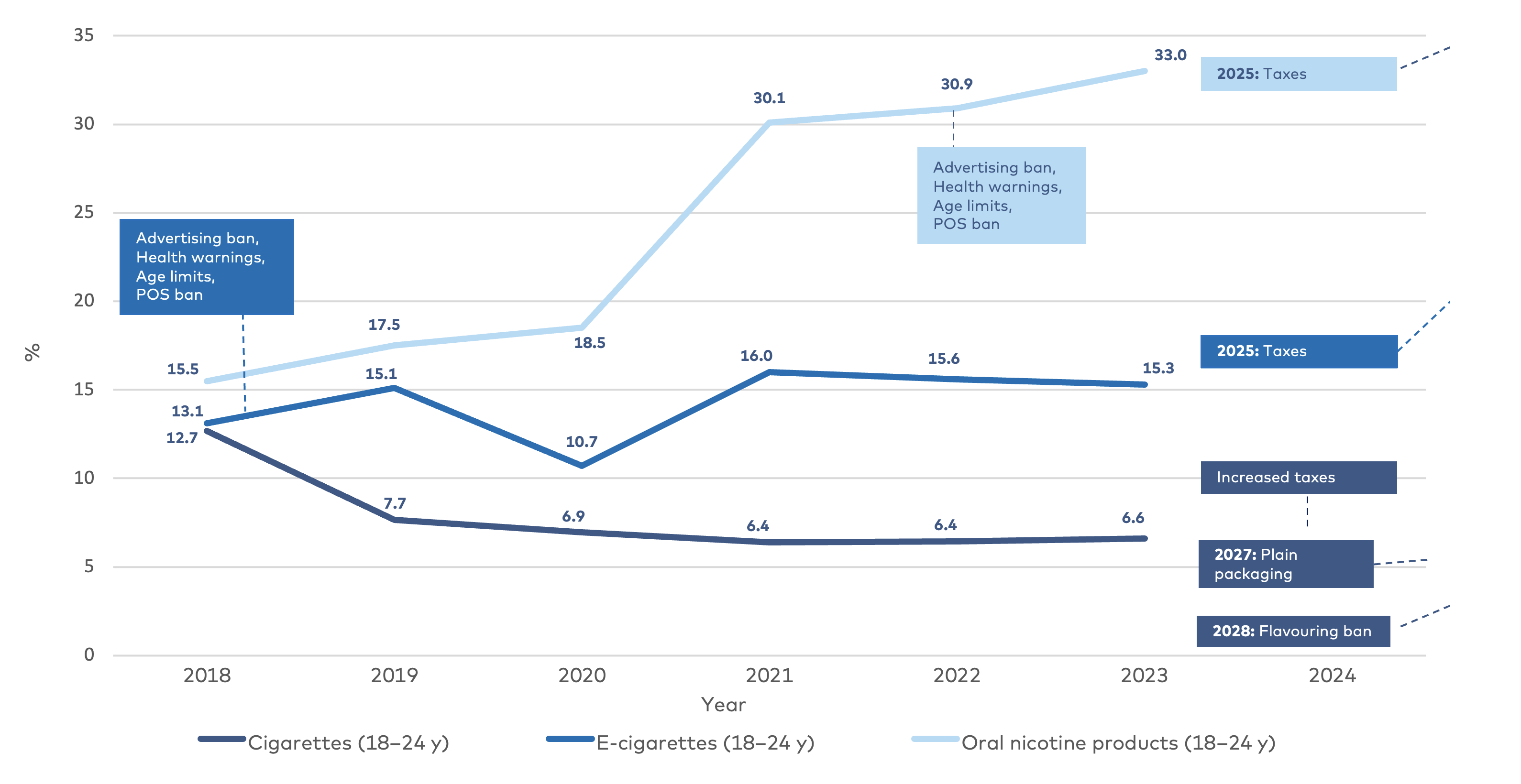

Figure 4.3. Use and regulations of cigarettes, e-cigarettes, and oral nicotine products in Iceland from 2018–2024

Prevalence data: Public Health Watch 2018–2023.

Note: Oral nicotine products only included snus until 2021, when nicotine pouches were also included in the measure.

Note: Oral nicotine products only included snus until 2021, when nicotine pouches were also included in the measure.

Norway

In Norway, nicotine products are regulated by the Tobacco Control Act (Helse- og omsorgsdepartementet, 2023). In 1989, Norway adopted a ban on new nicotine and tobacco products, but the ban was replaced in 2021 by an approval scheme largely based on Article 19 of the TPD. Hence, all novel tobacco and nicotine products introduced after May 19, 2014, need approval by the Norwegian Directorate of Health to enter the Norwegian market. There is an additional national requirement that novel products must not be appealing to children or contribute to the initiation or normalisation of tobacco products (Helse- og omsorgsdepartementet, 2021). Implementation of the 2014 tobacco products directive is expected to enter into force in 2025. This means, among other things, that e-cigarettes containing nicotine will be allowed in Norway.

Cigarettes are regulated by the Tobacco Control Act. Beyond the FCTC, Norway requires plain packaging and a POS display ban (the latter exempted in stores only selling such products). Cigarettes are subject to a tax of NOK 3.15 (€0.27) per cigarette (The Norwegian Tax Administration, 2024).

E-cigarettes are regulated by the Tobacco Control Act. E-cigarettes with nicotine are subject to the ban on new nicotine products. While the import and sale are currently prohibited, the sale of e-cigarettes without nicotine is permitted. However, e-cigarettes containing nicotine will be allowed when the TPD enters into force in Norway and will be subject to the registration scheme and health warnings according to the Directive Article 20. Currently, plain packaging and health warnings for nicotine-free e-cigarettes are not required, but such requirements have been adopted and are expected to enter into force in 2025 (Helsedirektoratet, 2024). However, characteristic flavours are prohibited, as are advertising and sponsoring. E-cigarettes must not be visible at POS (except in stores only selling such products). The use of e-cigarettes is prohibited in several public places, including school facilities. The legal age for buying e-cigarettes in Norway is 18 years. E-liquids are subject to taxation of NOK 5.11 (€0.44) per millilitre (The Norwegian Tax Administration, 2024).

Nicotine pouches are not allowed to be sold or imported into Norway (Helsedirektoratet, 2023). However, the sale of white snus in Norway is permitted, as it contains minimal amounts of tobacco and is thus regulated as snus (Salokannel & Ollila, 2021).

Snus is regulated as a tobacco product in the Tobacco Control Act. Snus must be in plain packaging, which is required to display a health warning. Characteristic flavours are not regulated. Advertising and sponsorship of all sorts is prohibited, and snus may not be visible at POS (except in stores only selling such products). The use of snus in various public areas is not regulated, but the use is prohibited at schools and kindergarten premises during the school hours. The legal age for buying snus in Norway is 18 years. Snus is subject to a tax of NOK 1.28 (€0.11) per gram of the packaging weight (The Norwegian Tax Administration, 2024).

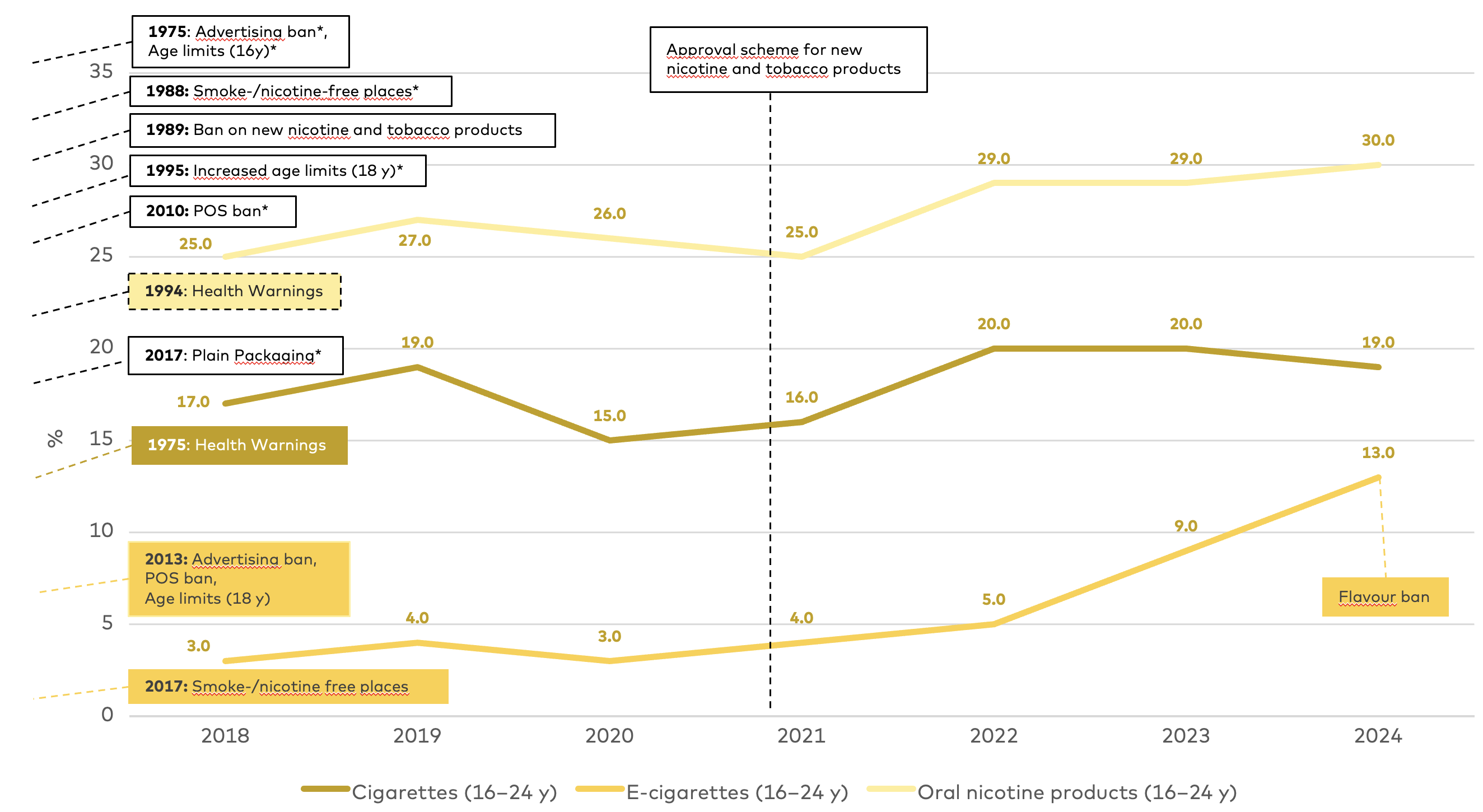

Figure 4.4. Use and regulations of cigarettes, e-cigarettes, and oral nicotine products in Norway from 2018–2024

Prevalence data: Drug Survey 2018–2024.

Note: *Regulations only concerning tobacco products, i.e. snus and cigarettes.

Note: *Regulations only concerning tobacco products, i.e. snus and cigarettes.

Sweden

In Sweden, nicotine products are regulated by the Law on tobacco and similar products (Socialdepartementet, 2018) and the Law on tobacco-free nicotine products (Socialdepartementet, 2022). Over the past years, several changes have been made to the regulative landscape of nicotine products in Sweden, especially by the introduction of the Law on tobacco-free nicotine products in 2022.

Cigarettes are regulated by the Law on tobacco and similar products. Beyond the TPD 2014, Sweden requires that POS are not visible from outside the store, and must not be intrusive, solicitous, or encourage use. Further, smoke-free environments in public places indoors and certain public places outdoors are regulated. Cigarettes are subject to a tax of SEK 2.01 per cigarette + 1% of the retail price, which results in a minimum tax of €0.17 per cigarette, depending on the retail price (Skatteverket, 2024).

E-cigarettes are regulated by the Law on tobacco and similar products. Packaging for e-cigarettes and refill containers must display a health warning, but there are no requirements of plain packaging. The content of characteristic flavours is not regulated. Advertising is restricted and sponsorship is prohibited. Display at POS is allowed but must not be intrusive, solicitous, or encourage use. Where smoking is not allowed, the use of e-cigarettes is also prohibited. The legal age for buying e-cigarettes in Sweden is 18 years. E-liquids with a nicotine concentration under 15 mg/ml are subject to a tax of SEK 2,020 (€178.71) per litre. E-liquids with a nicotine concentration between 15 and 20 mg/ml are subject to a tax of SEK 4,040 (€357.42) per litre of liquid (Skatteverket, 2024).

Nicotine pouches are regulated as tobacco-free nicotine products. Packaging for nicotine pouches must display a health warning, but there are no requirements of plain packaging. The content of characteristic flavours is not regulated. Advertising is restricted to adults over the age of 25 years and sponsorship is prohibited. Display at POS is allowed but must not be intrusive, solicitous, or encourage use. The legal age for buying nicotine pouches in Sweden is 18 years. Nicotine pouches are subject to a tax of SEK 202 (€17.86) per kg product (Skatteverket, 2024).

Snus is sold legally in Sweden, as it is exempt from the TPD 2014. This is argued by a long tradition of snus use in the Swedish society and is based on Sweden’s agreement not to market snus in other EU countries and the agreement to restrict distance sale. Packaging for snus must display a health warning, but there are no requirements of plain packaging. The content of characteristic flavours is not regulated. Advertising and sponsoring are prohibited. Advertising at POS is allowed but must not be intrusive, solicitous, or encourage use. The legal age for buying snus in Sweden is 18 years. Snus is subject to a tax of SEK 421 (€36,46) per kg snus (Finansdepartementet, 2022).

Figure 4.5. Use and regulations of cigarettes, e-cigarettes, and oral nicotine products in Sweden from 2018–2024

Prevalence data: National Public Health Survey 2018–2024.

Note: Oral nicotine products only included snus until 2022, when nicotine pouches were explicitly included in the measure.

Note: Oral nicotine products only included snus until 2022, when nicotine pouches were explicitly included in the measure.

Baltic countries

Estonia

Regulations on nicotine products in Estonia are regulated by several laws, but most prominently the Tobacco Act (Riigikogu, 2005). Amendments to the law concerning new nicotine products will enter into force on 1 January 2025. Some of these amendments will be elaborated below.

Cigarettes are regulated by the Tobacco Act. Beyond the TPD 2014, Estonia has implemented a point-of-sale display ban for cigarettes. As of 1 January 2025, cigarettes will be subject to a tax of €0.12 per cigarette + 30% of the maximum retail price. This results in a tax of €0.17 per cigarette (Tax and Customs Board, 2024).

E-cigarettes are regulated as products related to tobacco products in the Tobacco Act. Packaging for e-cigarettes must display a health warning, but there are no requirements of plain packaging. The content of characteristic flavours is restricted to menthol, mint, and tobacco. Advertising and sponsoring are prohibited, and e-cigarettes may not be visible at POS. The use of e-cigarettes is prohibited in various public places, including educational institutions. The legal age for purchasing and using e-cigarettes is 18 years (Riigikogu, 2005). As of 1 January 2025, e-cigarettes are subject to a tax of €0.22 per ml e-liquid (Tax and Customs Board, 2024).

Nicotine pouches are regulated as tobacco-related products in the Tobacco Act. Packaging for nicotine pouches must display a health warning, but there are no requirements of plain packaging. The content of characteristic flavours is not regulated. Advertising and sponsoring are prohibited, and nicotine pouches may not be visible at POS. The use of nicotine pouches is not allowed on premises of child and educational institutions. The legal age for purchasing and using nicotine pouches in Estonia 18 years. Distance sale is prohibited. As of 1 January 2025, nicotine pouches are subject to a tax of €0.22 per gram of product (Tax and Customs Board, 2024).

Snus is prohibited in Estonia in accordance with the TPD 2014.

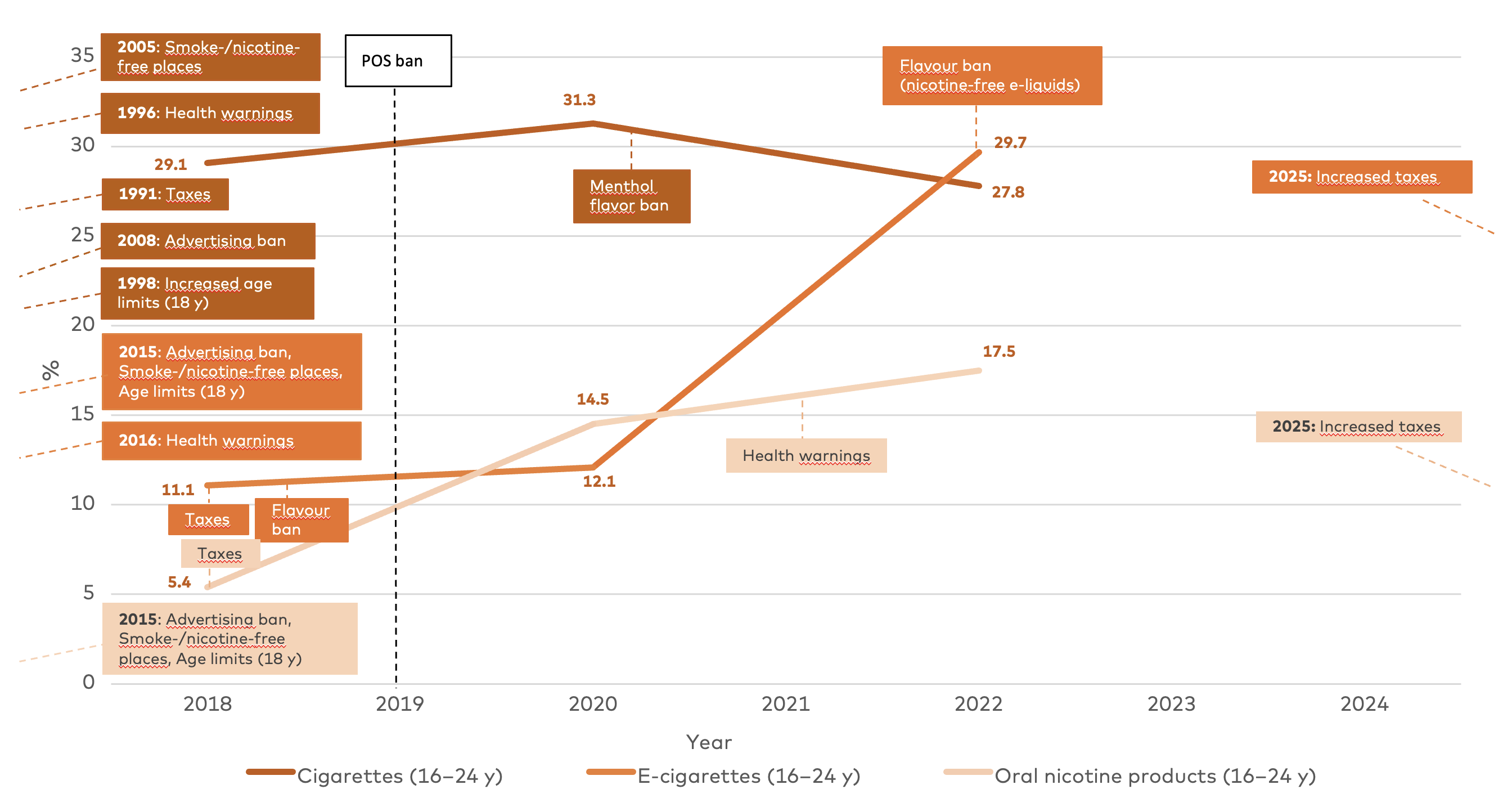

Figure 4.6. Use and regulations of cigarettes, e-cigarettes, and oral nicotine products in Estonia from 2018–2024

Prevalence data: Estonian Adult Population Health Behaviour Study 2018–2022.

Latvia

In Latvia, nicotine products are primarily regulated by the Law on the Handling of Tobacco Products, Tobacco Substitute Products, Herbal Products for Smoking, Electronic Smoking Devices and Their Liquids from 2016 (Saeima, 2016). Several amendments and changes to the law have been introduced in the past years to reduce the availability of new nicotine products, especially among youth in Latvia (Veselības ministrija, 2024).

Cigarettes are regulated by the Law on the Handling of Tobacco Products, etc. Beyond the 2014 TPD, Latvia has implemented a POS display ban for cigarettes. As of 1 January 2025, the age limit for purchasing and smoking will increase to 20 years. Cigarettes are subject to a tax of €0.16 per cigarette + 15% of the maximum retail price, which results in a minimum tax of €0.16 per cigarette, depending on the retail price (Ministry of Finance, 2023).

E-cigarettes are regulated as electronic smoking devices in Latvia. Packaging must display a health warning, but plain packaging is not required. It is prohibited to add fruits and other symbols related to the flavour of the product. As of 1 January 2025, the content of characteristic flavours in e-cigarettes with and without nicotine is restricted to tobacco. The list of allowed additives that provide the tobacco flavours will be added to the Tobacco Law. Advertising and sponsoring are prohibited across all forms of media, and e-cigarettes may not be visible at POS. E-cigarettes and cigarette smoking are prohibited in the same places, i.e. it is not allowed at educational institutions and various other public places or situations. As of 1 January 2025, the legal age for purchasing and using e-cigarettes is 20 years, and distance sale is prohibited (Saeima, 2016). E-liquids are subject to a tax of €0.24 per ml e-liquid (Ministry of Finance, 2023).

Nicotine pouches are regulated as a tobacco substitute product in Latvia. Packaging for nicotine pouches must display a health warning, but plain packaging is not required. As of 1 January 2025, the content of characteristic flavours is restricted to tobacco, and nicotine content must not exceed 4 mg per gram of product. The list of allowed additives that provide the tobacco flavours will be added into the Tobacco Law. Advertising and sponsoring are prohibited across all forms of media, and nicotine pouches may not be visible at POS. The use of nicotine pouches is not allowed in educational institutions and distance sale is prohibited. As of 1 January 2025, the legal age for purchasing and using nicotine pouches is 20 years (Saeima, 2016). Nicotine pouches are subject to a tax of €138 per kg of product (Ministry of Finance, 2023).

Snus is prohibited in Latvia in accordance with the TPD 2014.

Figure 4.7. Use and regulations of cigarettes and e-cigarettes in Latvia from 2018–2024

Prevalence data: Health Behaviour among Latvian Adult Population 2018–2022.

Note: There is no prevalence data on oral nicotine products in Latvia, therefore only regulations are presented here.

Note: There is no prevalence data on oral nicotine products in Latvia, therefore only regulations are presented here.

Lithuania

In Lithuania, nicotine products are regulated by the Tobacco Control Law (Republic of Lithuania, 1996). Amendments to this law are planned for 2025 to include tobacco-free products, such as nicotine pouches. In 2023, the Parliament of Lithuania presented a National Agenda on Drugs, Tobacco and Alcohol control, prevention, and harm reduction until 2035, followed by the approval of the 2024–2026 Action Plan for the implementation of this agenda (Government of the Republic of Lithuania, 2024; Parliament of the Republic of Lithuania, 2023).

Cigarettes are regulated by the Tobacco Control Law. Beyond the TPD, a POS ban will enter into force on 1 January 2025 (Republic of Lithuania, 2022). Additionally, as of 1 January 2025 cigarettes are subject to a minimum combined tax of €0.15 per cigarette (Republic of Lithuania, 2024).

E-cigarettes are regulated by the Tobacco Control Law. Packaging for e-cigarettes must display a health warning, and the packaging may not appeal to minors. The content of characteristic flavours is prohibited. Advertising and sponsoring are prohibited. A POS display ban will be implemented 1 January 2025. The use of e-cigarettes is not allowed at educational institutions and various other public places or situations. The legal age for buying, possessing, and using e-cigarettes in Lithuania is 18 years. As of 1 January 2025, e-liquids are subject to a tax of €0.63 per ml e-liquid (Republic of Lithuania, 2024; Valstybinė mokesčių inspekcija, 2024).

Nicotine pouches are prohibited in Lithuania (The 2024 Effective Anti-Smoking Policies Global Index, 2024).

Snus is prohibited in Lithuania in accordance with the TPD 2014.

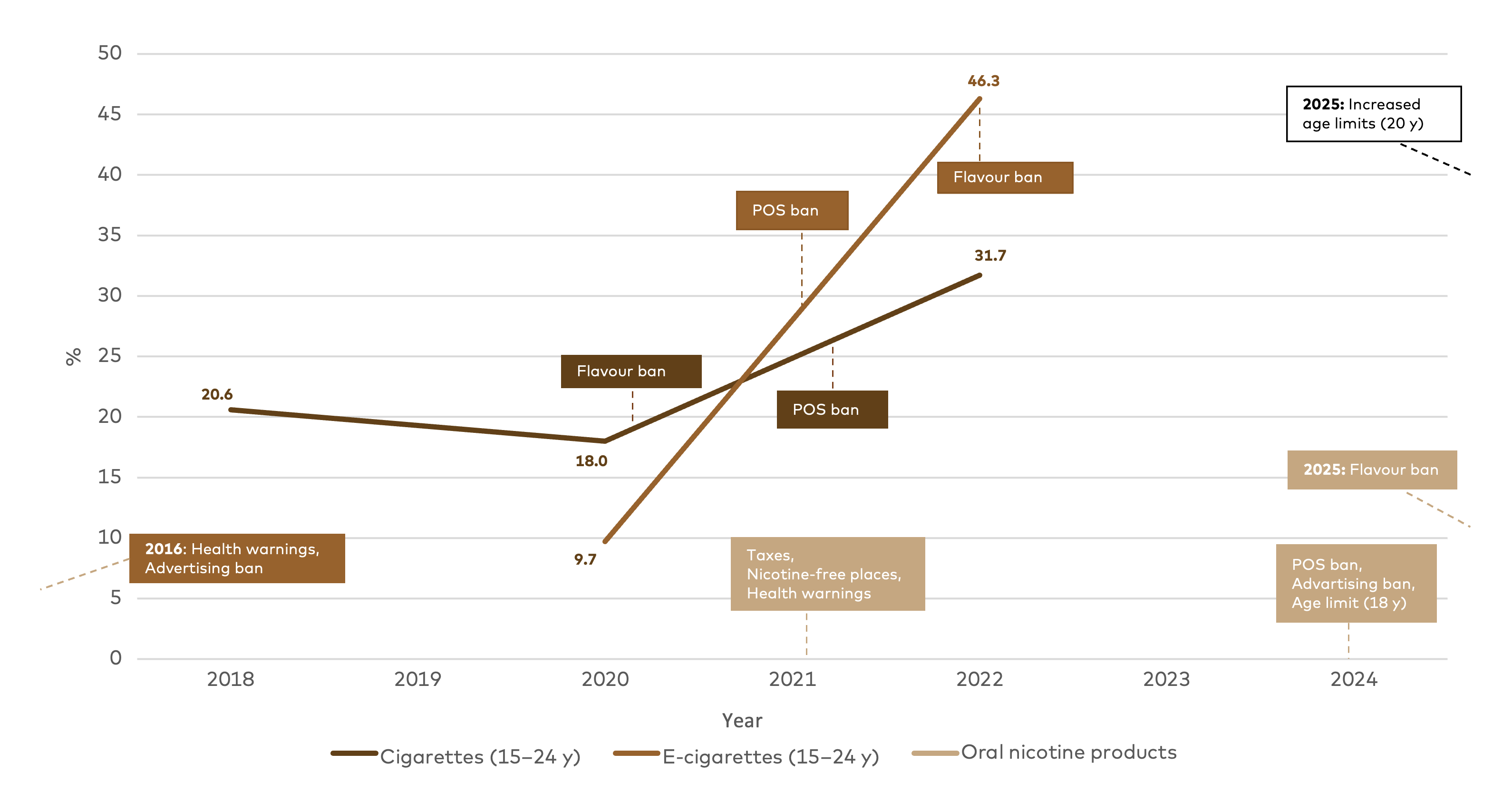

Figure 4.8. Use and regulations of cigarettes and e-cigarettes in Lithuania from 2018–2024

Prevalence data: ESPAD 2019+2024.